America has a growing wealth inequality problem that its political class seems incapable of fixing.

According to a report by international non-governmental organization Oxfam, the richest 1% of people have amassed roughly two-thirds of all new wealth created globally.

In total, $42 trillion in new wealth has been created since 2022, with $26 trillion (63%) being captured by the top 1% of the wealthiest individuals on the planet. Additionally, Oxfam noted that 99% of the global population amassed only $16 trillion of newly generated wealth.

The Oxfam report highlighted:

A billionaire gained roughly $1.7 million for every $1 of new global wealth earned by a person in the bottom 90 percent.

Gabriela Bucher, executive director of Oxfam International, pushed for tax hikes on the richest individuals across the West. She believes that this is “strategic precondition to reducing inequality and resuscitating democracy.”

While there are legitimate concerns about select groups of individuals accumulating disproportionate amount of wealth, increasing the size of government through taxation is not only counterproductive, it consistently hurts the poor. Let’s face it, the rich are notorious for knowing how to circumvent the tax system and will find ways to park their wealth elsewhere. On top of that, not all billionaires made their wealth illegitimately. Some have provided goods and services that society has deemed to be useful, which results in them being handsomely rewarded in terms of revenues and profits. And finally, government tax schemes somehow always end up extracting money from people who are not “rich.”

Instead, there needs to be a fundamental re-assessment of why we’re reaching such an unstable economic state. Thomas Massie (R-KY) is one of the few elected officials who understands the fundamental economic issues of our time.

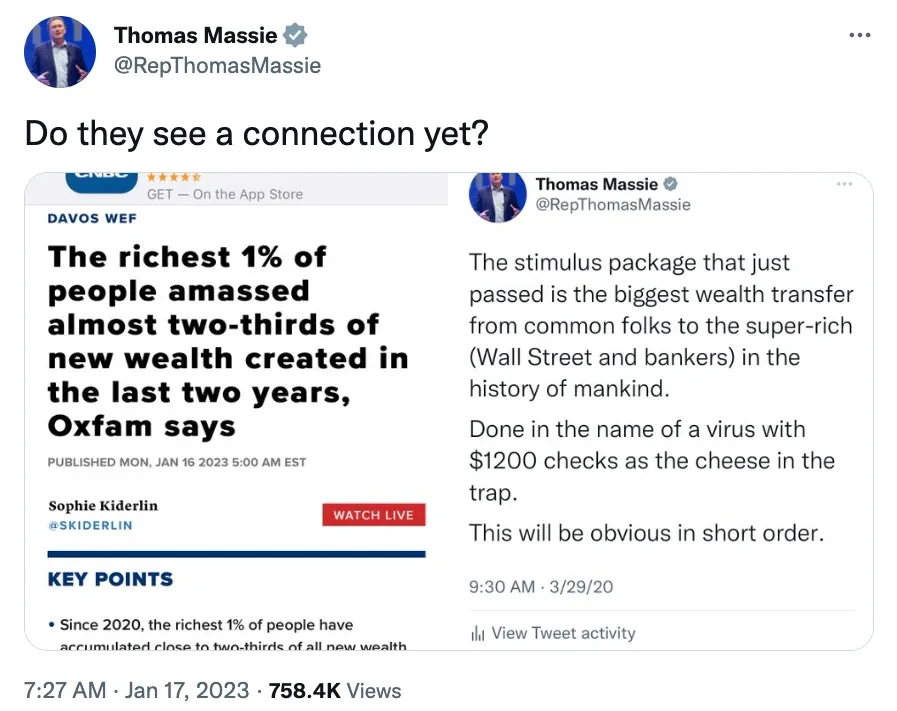

On Twitter, Massie posted a screenshot of a CNBC article highlighting the Oxfam report and juxtaposed it to a tweet he made on March 29, 2020. Massie tweeted:

Do they see a connection yet?

The tweet Massie originally posted referenced the $2.2 trillion coronavirus stimulus plan that both parties rapidly passed on March 27, 2020. At the time, Massie tweeted:

The stimulus package that just passed is the biggest wealth transfer from common folks to the super-rich (Wall Street and bankers) in the history of mankind.

Done in the name of a virus with $1200 checks as the cheese in the trap.

This will be obvious in short order.

There are consequences to fiscal profligacy and loose monetary policies. By running massive deficits, the US’s national debt crisis magnifies, thereby leaving future generations saddled with a back-breaking debt burden. Even more pernicious is the political class’s response to the country’s reckless spending policies.

When it becomes clear that the country’s fiscal house cannot be straightened out, politicians eventually turn to monetary expansion to finance government largesse and to also devalue the debt burden. After all, inflation benefits debtors due to the devalued debt. However, this entire process opens the Pandora’s Box of inflation.

The US is already experiencing a nasty episode of mass inflation that is disproportionately hurting the middle class. Inflation wipes out the savings — the bedrock of a sound economy — of the middle class, while benefiting debtors.

The US is already experiencing a nasty episode of mass inflation that is disproportionately hurting the middle class. Inflation wipes out the savings — the bedrock of a sound economy — of the middle class, while benefiting debtors.

Moreover, inflation disproportionately benefits the rich. This is where the Cantillon effect comes into play. During the 18th century, the French-Irish economist Richard Cantillon observed that the closer individuals were to the crown and the moneyed interests, the more they prospered. The way elites prospered during inflationary bouts was through their ability to buy cheap financial assets and subsequently watch their asset prices inflate.

Banks and other financial institutions tend to be the first beneficiaries of the newly printed money. These institutions are well-positioned because they can channel the surplus liquidity into financial assets. They achieve this by buying assets at low prices.

Overall, the cocktail of big spending and loose money turns into a massive redistribution program for the rich. Unlike his congressional counterparts, Massie grasps this dynamic. For him, reducing the size of government and returning to sound money is the answer to this problem. Raising taxes and regulations only perpetuates the status quo of growing wealth inequality and ends up making society poorer as a result.

If the US wants economic stability, its policymakers must roll back the size of the state.