Experts predict the Supreme Court will rule against President Biden’s student loan forgiveness program, protecting hundreds of millions of American taxpayers from bearing the burden of the transferred debt.

According to a Lending Tree poll, approximately 50% of surveyed Americans are against mass forgiveness programs. Many claim it would be unfair to those who never took out loans or those who already paid them off.

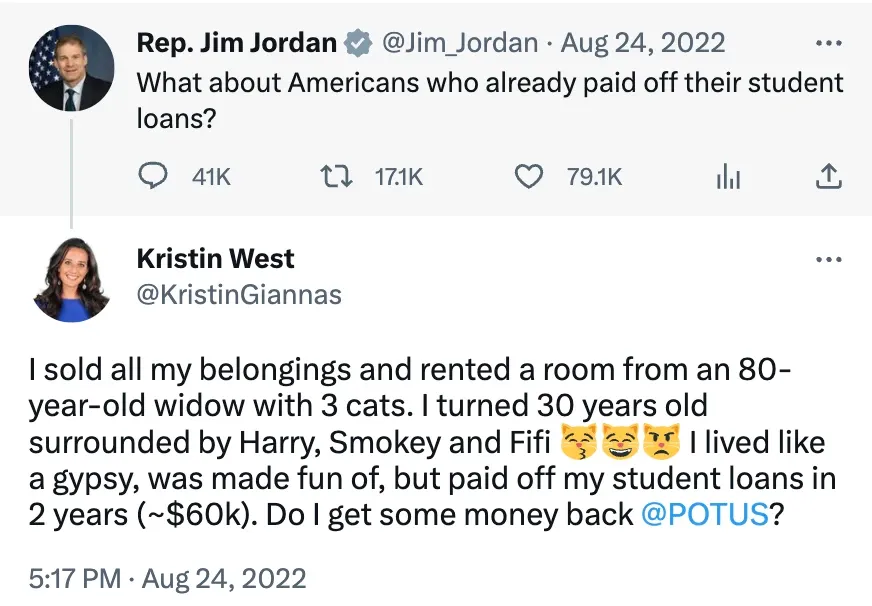

When Biden first announced his debt cancellation plan, Rep. Jim Jordan, (R-OH) tweeted a question about whether it was fair to those who already paid off their debt.

Meteorologist Kristin West shared how she sold everything, rented a tiny room and lived very frugally to pay off her student loans in two years. In her reply, she asked whether Biden would give her money back.

Writer Matthew Noyes echoed the sentiment that student loan forgiveness is not fair for those that already repaid their loans.

While millions of borrowers like West and Noyes took steps to live frugally and repay their loans off quickly, there are millions of borrowers that took out excessive loans to pay for many non-school related expenses.

According to a report by LendEDU, 56.78% of in-school student borrowers have used loan money to fund vacations, such as spring break trips. Students have also used loan money to go out to bars, purchase alcohol, buy drugs, and gamble.

LendEDU also reported that nearly 50% of surveyed students took out these loans believing the government would pay them back.

Additionally, Biden’s plan of forgiving up to $20,000 in student loans for every eligible borrower would cost the federal government between $469 billion and $519 billion over 10 years. This would impact taxpayers through increased inflation, a higher national deficit and rising individual taxes.

The Committee for a Responsible Federal Budget claims “the student debt changes will increase inflation in three ways – by reducing the amount of income households use to pay down debt over the next year, by increasing household wealth, and by putting upward pressure on tuition costs.”

There is also a misunderstanding about the debt being canceled. Less than 44 million Americans have student loans, which is approximately 13% of the population. Collectively though, they owe more than $1.6 trillion.

Under Biden’s plan, the debt does not disappear. It would be transferred to the federal government and added to the national deficit, costing taxpayers thousands of dollars over their lifetime.

Biden’s debt cancellation plan will also have a negative impact on college tuition. Many studies have shown that tuition increases in correlation with the amount of money available to borrow. With more money available, tuition costs will continue to rise.

As for the cases challenging Biden’s plan, the Court heard arguments in two of the cases examining two key issues, specifically whether the petitioners meet the constitutional requirement for “standing” and whether the Department of Education has the authority to forgive student loan debt.

The Administration claims the Higher Education Relief Opportunities for Students (HEROES) Act of 2003 provided the authority to forgive student loans.

The HEROES Act was passed after the 9/11 terrorist attacks to allow the federal government the authority to relieve soldiers of their student loan debt when they entered active duty.

The act grants authority to the Secretary of Education to waive statutory or regulatory provisions related to student loan repayment programs during a time of “a war or other military operation or national emergency.”

Biden insists that the COVID-19 pandemic created an emergency, which gives him authorization under the HEROES Act to forgive student loan debt. Opponents claim that the HEROES Act does not provide authority for such sweeping cancellation as it was passed to cover a very limited scope.

Opponents also claim that even if the pandemic was a qualifying event under the HEROES Act, Biden claims that the pandemic is over, which means the qualifying “national emergency” no longer applies.

The two key cases were heard in February, and the Court is predicted to publish its ruling this June.