Solar power is becoming a popular alternative to traditional fossil fuel generated electricity, but the booming industry is creating consumer confusion in the marketplace, leading many to end up with the same electric bill and a monthly payment for installing the solar panel system.

According to the Solar Energy Industries Association (SEIA), solar power is expected to experience a 21% annual growth between 2023 and 2027. Although residential solar companies are regulated by both state and federal laws, many consumers are still falling victim to unfair or deceptive sales practices.

For anyone that has ever searched for information about solar power, they have most likely experienced what some call the “solar power vortex.” With one simple internet search, a person’s social media feed, email inbox, and text messages become filled with offers from the competitive solar power sector. Some companies even use aggressive door to door sales tactics to find potential customers.

With one simple internet search, a person’s social media feed, email inbox, and text messages become filled with offers from the competitive solar power sector.

Solar power can save consumers money on their electric bill, but many people do not completely understand how the savings work or the upfront costs associated with installing a system.

Installation costs vary from $16,000 to over $35,000 depending on several factors, including location and system design. There is a federal residential solar energy credit that helps reduce these upfront costs, but it’s not a cash payment. It is only a tax credit that can reduce one’s overall income tax owed.

Some companies have misled consumers into thinking they would receive the tax credit as a check from the government. PowerHome, a now bankrupt solar company, received thousands of complaints and was the subject of several lawsuits due to their deceptive sales tactics.

During an undercover news investigation, PowerHome sales consultants were caught on camera telling homeowners that they would receive the tax rebate as a check that can be used for anything. Additionally, they lied about the amount of power their systems would provide.

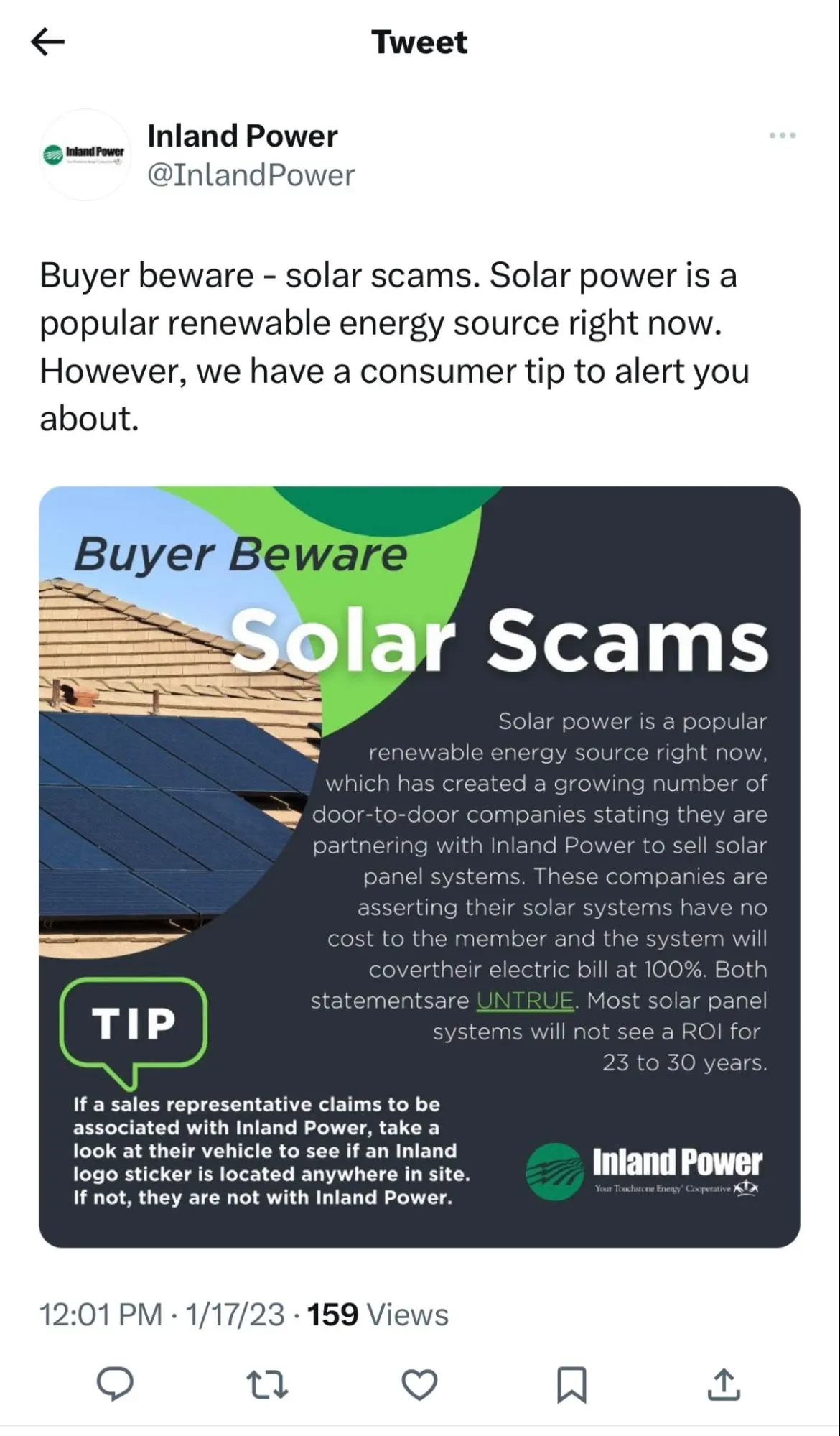

The number of solar scams is increasing so fast that several solar power companies are issuing scam alerts.

The number of solar scams is increasing so fast that several solar power companies are issuing scam alerts. Inland Power tweeted a scam warning with the specific clarification that solar systems will not cover customer electric bill at 100%, and a return on the initial investment will usually not be realized for 25 to 30 years.

Because of the high installation cost, many people choose to finance it, usually at an amount close to what their electric bill was. Homeowners would rather spend the money each month to invest in the solar energy system rather than pay a utility company.

One of the main issues with financing the upfront investment is that the finance term could potentially be longer than the system warranty. Most warranties are between 10 to 25 years. If the cost is financed over 20 years, there is a potential issue that once the system is paid off it will be out of warranty and the owner would have to cover any repair costs or system replacement.

For those that want to avoid the upfront costs associated with owning the solar system, they can consider solar leases or power purchase agreements (PPAs). Both of these options mean that a third party owns and installs the systems. This reduces some of the costs, but it also reduces the benefit. Neither of these options qualify for the solar tax credit.

For those experiencing high electric bills or those tired of dealing with skyrocketing energy costs, solar power is a viable option, but as the Better Business Bureau advises, it’s important to research all the aspects associated with solar power before making a decision.

In a solar lease, the homeowner would pay a fixed monthly amount, but there is no guarantee that the rate paid would be less than what is paid to the utility.

In a PPA, the homeowner pays per kilowatt hour, meaning the homeowner is paying to use the power generated by the solar system.

Solar leases and PPAs can also limit the ability of a homeowner to sell their house as a potential buyer would have to agree to the lease or agreement.

For those experiencing high electric bills or those tired of dealing with skyrocketing energy costs, solar power is a viable option, but as the Better Business Bureau advises, it’s important to research all the aspects associated with solar power before making a decision.