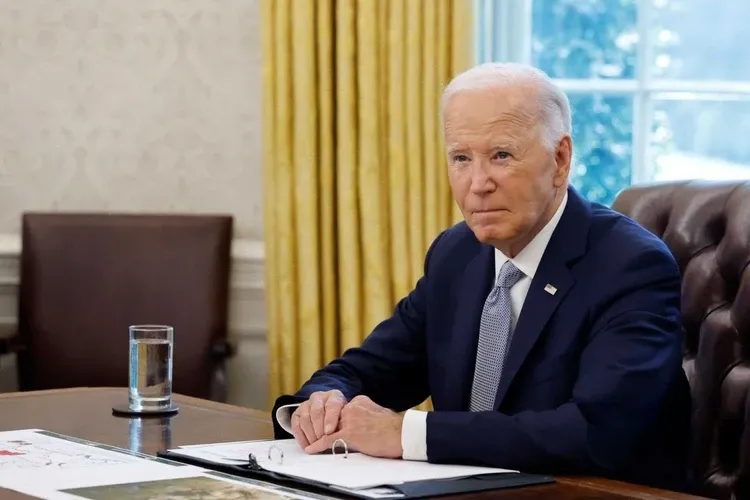

Securities and Exchange Commission officials announced that they would cease to defend a rule passed under now-former President Joe Biden that required publicly held companies to disclose their purported climate-related risks.

The federal rule, approved last year on a party-line vote by SEC commissioners, forced disclosures about emissions when such information could impact an investment decision. Mark Uyeda, the current acting chair of the SEC, announced in a Tuesday statement that the rule is “deeply flawed and could inflict significant harm on the capital markets and our economy.”

Uyeda noted that both he and commissioner Hester Pierce voted last year against the climate disclosure rule. Pierce had asserted that “only a mandate from Congress should put us in the business of facilitating the disclosure of information not clearly related to financial returns.”

The rule is currently moving through litigation in the Eighth Circuit Court of Appeals, meaning that Uyeda will ask the Eighth Circuit not to “schedule the case for argument to provide time for the commission to deliberate and determine the appropriate next steps in these cases.”

Uyeda also referenced an executive order from President Donald Trump requiring agencies to broadly freeze all new regulations that are not first directly reviewed by leaders of the agencies.

The climate-related risk rule received substantial criticism from Republicans who contended that the regulation was part of the environmental, social, and corporate governance movement, which advocates for companies to advance leftist social policies unrelated to their profitability.

South Dakota Republican Senator Mike Rounds, a member of the Senate Banking Committee, praised the decision not to defend the rule, noting that the standard “would have burdened farmers, ranchers, and small businesses with costly reporting requirements and red tape.”